What is a Perpetual Inventory Management System?

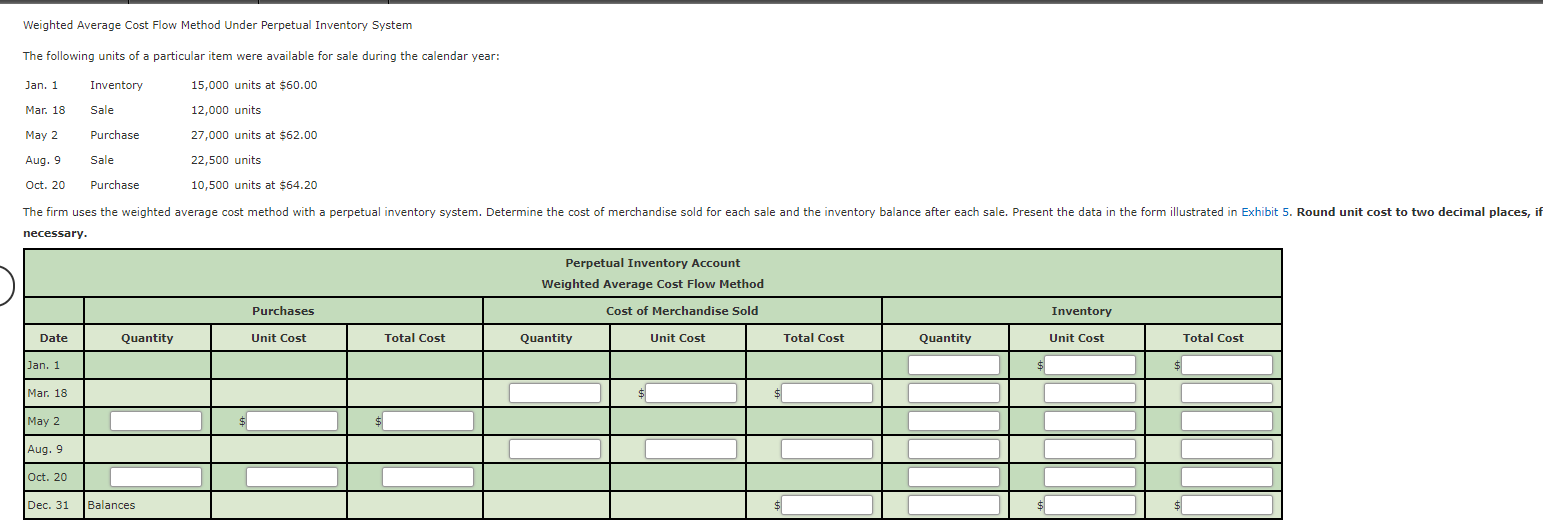

However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system. FIFO (first in, first out) refers to an accounting system that assumes the oldest products are sold first, followed by newer ones. LIFO (last in, first out) assumes the most recent products are sold before older ones.

What Is the Difference Between Perpetual and Periodic Inventory Systems?

As just noted, a perpetual inventory system maintains inventory balance information in real time. A periodic inventory system does not maintain such an accurate set of inventory records. Instead, a periodic system relies on an occasional physical inventory count, perhaps on a quarterly or annual basis. At all other times, the inventory records under a periodic inventory system will not reflect the amount of inventory that is actually on hand. Despite their inherent inaccuracy, periodic inventory systems can be useful in situations where the inventory value is low and a company does not have much of it. In these situations, a simple manual scan of the inventory may be sufficient to verify whether there is any inventory on hand.

Do you already work with a financial advisor?

FIFO (first in, first out) is an inventory valuation method that sells the goods purchased first before goods purchased later. In theory, this means the oldest inventory gets shipped out to customers before newer inventory. EOQ, or economic order quantity, is designed to find the optimal order quantity for businesses to minimize certain things like costs, warehousing space, and stockouts. Historical inventory and sales data can be used to predict future sales cycles and ensure that you have an optimal amount of inventory during different times in the season, such as the holidays. The perpetual inventory system is a reliable way to keep track of inventory in real-time.

Would you prefer to work with a financial professional remotely or in-person?

- Businesses can simplify the inventory costing process by using a weighted average cost, or the total inventory cost divided by the number of units in inventory.

- We’ll also discuss the pros and cons of using a perpetual inventory system in various scenarios.

- The perpetual inventory system provides businesses with real-time information on inventory levels, allowing them to make informed purchasing and sales decisions and reduce inventory holding costs.

- This improves the overall accuracy of your inventory records, which is essential for effective decision-making.

As a result, the inventory that is still on hand after the time period is the most recent. A cost flow assumption is an inventory accounting technique determining the value of the ending inventory and the cost of goods sold. It uses the original value of products from the beginning inventory of a period and purchases of new inventory made during that period.

How frequently does a physical inventory need to be taken with a perpetual inventory system?

The same applies to the margin for error, which is lower with a perpetual system, although a limited, uncomplicated inventory may not suffer much with a periodic system. The 3 cost flow assumptions are FIFO, LIFO, and the Weighted Average Cost (WAC). Inventory formulas can inform you when to order more stock, the quantity to order, the lead time required and the safety stock level. Keep overstatements, also known as phantom inventory, as well as missing inventory understatements to a minimum with using perpetual inventory.

Point-of-sale system updates inventory levels

EOQ is a formula that managers use to decide when to purchase inventory based on the cost to hold inventory as well as the firm’s cost to order inventory. To calculate inventory, companies need to set up a system where every piece of inventory is entered into the system and deducted from the system as it’s sold. This requires the do insurance payouts have to be counted as income use of point-of-sale terminals, barcode scanners, and perpetual inventory software to update estimated inventory with every product purchase and sale. It uses historical inventory and sales data to predict future sales trends and cycles and ensure you have the optimal stock at the right time of year, such as the holiday season.

The main advantage of a perpetual inventory system is that it provides the firm with real-time information concerning its inventory levels, and also saves time. To simplify the illustration, all items are assumed to have had the same cost, $2.00. Also, as already noted, some perpetual records maintain only a record of units.

Additionally, cloud-based inventory management systems are often real-time, a key element of a perpetual inventory system. A periodic inventory system updates and recordsthe inventory account at certain, scheduled times at the end of anoperating cycle. The update and recognition could occur at the endof the month, quarter, and year. There is a gap between the sale orpurchase of inventory and when the inventory activity isrecognized. Effective management of inventory is essential for businesses of all sizes to maintain optimal inventory levels, minimize risks of overstocking or understocking, and achieve operational efficiency.

From sole traders who need simple solutions to small businesses looking to grow. In our example, let’s say the purchase order goes through, and after a week or two your supplier’s shipment of 500 candles arrives at your warehouse. Whenever an item or SKU hits its reorder point, the system generates a new purchase order and sends it to your supplier with no human intervention. Following the previous example, let’s say your store offers a special holiday-themed candle, and for the past 4 years, sales for that candle have always risen in Q4. “When we started selling in the US, we were still adjusting to the learning curve and didn’t fully understand how seasonal our business would become.

So, employees can use the WMS to quickly scan the product whenever inventory is sent to a warehouse. The product will then automatically appear in the inventory management dashboard, available for sale on all sales channels. A perpetual inventory system uses the business’s historical data to automatically update these reorder points and keep inventory levels optimal at all times. Compared to a periodic inventory system, this form of inventory accounting offers a more precise and effective way to account for inventory.