Petty Cash Creating, Disbursement, Replenishing, Journal Entry

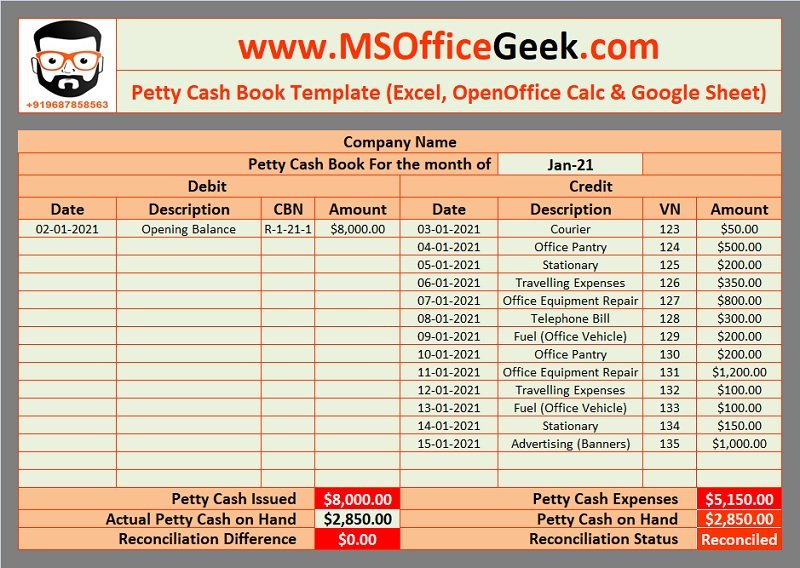

Here is the simple petty cash book which can help the accountants to control the cash flow. Particular cash that is used to pay for day-to-day petty expenses in a firm is called petty cash. In this petty cash system, the petty cashier will submit a statement of expenditure for approval at the end of a set period.

Adapt to changes with regular revisions

Put your petty cash policy in writing and offer some examples of appropriate expenses. For example, petty cash may be used to purchase additional postage, paper towels, coffee, or other basic office supplies. You can also mandate that all petty cash transactions be under a certain dollar amount, like $25. Volopay prepaid cards and expense management system take care of that as well.

Creating a Petty Cash Fund

For very small businesses, this additional task might outweigh the benefits. This flexibility can be crucial for SMBs that need to make quick purchases or handle minor emergencies without delay. Let’s explore both sides of the coin to help you make an informed decision for your business. Check out 5 tips for securing the capital you need to scale your business. It’s the financial equivalent of the loose change in your pocket – readily available for those small, unexpected costs that pop up in daily operations. Let’s dive into its world and discover how this financial resource can become your small business’s secret weapon for efficiency and flexibility.

To Ensure One Vote Per Person, Please Include the Following Info

For modern petty cash systems that are digital, you must ensure that there are sufficient IT measures in place to avoid any kind of theft through hacking. Being able to see the closing balance helps people decide how much they should spend and where is it that they should invest the remaining funds. Without the visibility of available funds, employees may end up making decisions that are not financially sound. You might think that petty expenses are of small amounts and can be made on the go; why do you have to account for those as well?

- A petty cash fund is a small fund whose purpose is to make small disbursements of cash.

- Ideally, a financial controller or a member of the finance team should be responsible for checking, reviewing, and auditing the petty cash book at a fixed interval.

- The check is cashed and the money is placed under the control of one designated individual.

- When a petty expense is recorded on the right-hand side of the book, the same amount is also recorded in the proper expense column.

- The company’s administrative department usually maintains the petty cash book as the accounts departments generally take care of more significant business transactions.

When the whole amount is spent, the petty cashier submits the details of petty expenditures recorded in the petty cash book to the head or chief cashier for review. Under this system, the petty cashier is given a lump sum to meet petty expenses. When how to create 7 multiple streams of income: new guide 2023 the whole amount of petty cash is spent, the petty cashier submits the account to the chief cashier who again pays a lump sum to the petty cashier. A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams.

Ensures quicker reimbursement

With a direct accounting integration feature, all expenses are automatically entered into the accounting sheets. Establishing a culture of accountability is pivotal in reducing fraud risks. Learn about petty expenses, what is a petty cash book, petty cash book format, types of petty cash books, and much more. Petty Cash book is the book which records small cash payment and receipt during daily business operation.

Audits serve as a critical mechanism for detecting discrepancies, ensuring adherence to policies, and maintaining the integrity of financial records. The petty cash fund should have enough money to cover the daily expenses of employees who have access to it. But at the same time, you also want to ensure that excess cash isn’t left in this fund as there is always the risk of theft or fraud. Basically, the petty cashier receives money from the head accountant in the form of a cheque. That cheque is then converted to cash in the bank and recorded on the receipts side of the petty cash book. All business expenses are equally important and must be tracked to maintain a steady cash flow and not go overboard, which damages the baseline.

The companies have widely adopted Imprest Petty Cash System to run their petty cash account. Under the petty cash Imprest System, the petty cashier amount is fixed for a given period, usually a month or a week. Under this period, the cashier must run the petty cash account under the given budget. At the end of the period, the cashier submits the report, and the amount spent by him is reimbursed so that the amount becomes equal to the beginning balance at the starting of the previous month.

At the end of the period, the total spent is reconciled with the remaining cash to ensure accuracy and prevent discrepancies. A designated employee, like an office manager or finance assistant, should handle petty cash. This person acts as the “custodian.” They’re responsible for tracking transactions, keeping the cash secure, and reconciling the fund regularly. It’s advisable to limit access to just one or two people to maintain accountability and reduce errors.

The finance team will verify the past expenditures and send a cheque for petty expenditures for the next period. Determining the right amount of petty cash for your business is crucial for maintaining efficiency without exposing yourself to unnecessary risk. While all expenses need to be recorded, it allows for a simplified system of tracking small costs. By allocating a fixed amount to a sundry fund, businesses can better control and predict small-expense spending.

In a columnar petty cash book, different columns are used to record various types of expenses separately. Common columns include date, particulars (description of expense), voucher number, amount spent, and a running balance. Calling it a formal summarization of expenditures involving petty cash expresses the petty cash book meaning better. These expenses are the regular day-to-day expenses of a business that are not related to the company’s direct line of business. Therefore, it is an accounting book for recording small expenses with little value.